Introduction

Today, sustainable development – development that meets the needs of the present without compromising the ability of future generations to meet their own needs1 – is at the centre of the global policy agenda, with the UN’s Sustainable Development Goals and the Paris Agreement establishing a common platform for international cooperation in the area of development and climate change. The three main pillars of sustainable development are economic growth, environmental protection and social equality.

This chapter looks at the extent to which environmental protection and economic growth go hand in hand and reinforce each other. The confluence of economic growth and environmental sustainability has become known as “green growth”. Green growth supports the creation of wealth, jobs and economic opportunities and contributes to rising living standards, while at the same time preserving natural resources and environmental public goods (such as clean air and water) for future generations. Many international organisations, including the EBRD, are now focused on achieving sustainable, green growth.

Environmental protection can make markets more efficient by correcting market externalities (such as those relating to air quality), while clean innovation can unleash a period of Schumpeterian “creative destruction”, triggering a virtuous cycle of reinvention, renewal, investment, market entry and growth.2 Indeed, there is growing evidence that economic prosperity can be reconciled with environmental concerns. For example, the declining cost of renewables means that they are, in some instances, just as cost-competitive as fossil fuels, particularly when the environmental cost of energy production is factored in.3 In 2017, Tesla (which makes electric cars, lithium-ion batteries and solar panels) surpassed all traditional car-makers except Daimler, Toyota and Volkswagen in terms of market capitalisation – thanks to its growth potential, rather than its current profitability.

All of the countries in the EBRD region have, to differing extents, made commitments to greener growth,4 moving away from the cheap energy and chronic environmental neglect of the central planning era. Green growth is seen as an opportunity in environments where traditional sources of growth have largely been exhausted. However, the extent to which environmental commitments will be implemented and achieve the desired outcomes remains to be seen.

This chapter starts by assessing the progress that has been made in the area of greenhouse gas (GHG) emissions.5 It looks at trends in terms of GHG emissions, the carbon intensity of energy production and the energy intensity of output, contrasting the EBRD region’s performance with that of comparator countries with similar economic characteristics. It then examines the role played by policy, looking specifically at energy subsidies, which affect firms’ choices when it comes to energy usage.

It then looks at whether producing goods in an environmentally friendly manner or selling green products is also beneficial for firms’ financial performance, in addition to the social benefits of greener production. This analysis contrasts the performance of firms in the EBRD region with that of firms elsewhere.

In light of the global policy focus on green growth, this chapter then uses sector-level data to assess the green growth potential of various industries in the EBRD region.

It is worth noting that there are many different aspects of green growth, including low-carbon growth, climate resilience and environmental sustainability. In the EBRD context, countries and projects are assessed in terms of their expected impact on the mitigation of climate change, adaptation to climate change and other environmental areas (see Box 4.1). For reasons of data availability, this chapter often focuses on the low-carbon dimension, but climate resilience and environmental sustainability are just as important.

Progress on reducing GHG emissions

The EBRD region from a comparative perspective

The Paris Agreement on climate change calls for very aggressive reductions in GHG emissions – particularly CO2 emissions, which account for more than three-quarters of all GHG emissions worldwide. CO2 is released into the atmosphere through the burning of fossil fuels, solid waste, trees and wood products, and also as a result of certain chemical reactions (those occurring, for example, in the manufacturing of cement).

Since the start of the transition process, the EBRD region has witnessed substantial reductions in GHG emissions, whether emissions are measured in aggregate terms, on a per capita basis or per US dollar of GDP (see Chart 4.1). While this is encouraging, much more remains to be done. Although the region’s emissions per capita declined in the 1990s, reaching their lowest point in 2000, they have since increased again.

Today, many of the countries in the EBRD region are still among the most carbon-intensive in the world. The region’s GHG emissions per capita and per US dollar of GDP remain around 20 per cent higher than in comparator countries – emerging markets that are similar in terms of their populations and per capita incomes (see Chapter 1 for methodological details). This is despite the fact that GHG emissions per capita in comparator countries have been steadily rising since the early 1990s, in contrast with trends in the EBRD region.

Almost 80 per cent of all GHG emissions worldwide originate in the energy sector. There is, of course, significant variation across countries: rich countries’ emissions are largely dominated by power and transport, middle-income countries’ emissions are shaped by power and industry, and poor countries’ emissions stem largely from agriculture. In the EBRD region, the percentage of GHG emissions originating in the energy sector has been relatively stable at more than 70 per cent since the early 1990s. In comparator countries, by contrast, the energy sector’s contribution to emissions has gradually increased over that period, but it remained below the 70 per cent mark in 2013.

CO2 accounts for 94 per cent of all energy-related GHG emissions. In order to understand the trends in energy-related CO2 ( ), it is useful to break total emissions down into their three contributing factors: carbon intensity (carbon emissions per unit of energy), energy intensity (energy use per unit of GDP) and GDP:

), it is useful to break total emissions down into their three contributing factors: carbon intensity (carbon emissions per unit of energy), energy intensity (energy use per unit of GDP) and GDP:

As GDP rises, the carbon intensity of energy production and/or the energy intensity of output have to fall in order for overall carbon emissions to decline. The next two subsections analyse recent trends in carbon intensity and energy intensity.

Chart 4.1

Source: World Resources Institute (2017) and authors’ calculations.

Note: Data represent unweighted averages across countries. Comparator countries are emerging markets that are similar in terms of population size and income per capita (see Chapter 1 for details). “MtCO2e” stands for “million metric tonnes of carbon dioxide equivalent”.

Carbon intensity in the energy sector

The carbon intensity of the EBRD region’s energy sector has declined substantially since 1992 (see Chart 4.2). It remains below the level observed in 1992, despite an upward trend since 2009. In most countries, carbon intensity has either decreased since the early 1990s or remained more or less constant. In Mongolia, however, carbon intensity has more than doubled since 2008 as a result of a mining boom.

That being said, many countries’ energy sectors are still among the most carbon-intensive on the planet. Indeed, coal-rich Mongolia’s energy sector was the most carbon-intensive in the world in 2013, with its carbon intensity more than 70 per cent higher than that of North Korea (which was ranked second). Meanwhile, Bosnia and Herzegovina, Estonia, Kazakhstan, Jordan, Lebanon, Morocco, Poland, Cyprus and FYR Macedonia were (in declining order of carbon intensity) also in the top 20 economies worldwide in terms of the carbon intensity of their energy sectors.

In the comparator countries, meanwhile, the carbon intensity of the energy sector has increased over the same period, but remains below the average for the EBRD region. The greater carbon intensity in the EBRD region stems from a combination of two factors. First of all, at the start of the transition process, industry accounted, on average, for 38.4 per cent of GDP in the EBRD region, compared with 36.0 per cent in the comparator countries. And second, despite a shift away from coal and oil towards natural gas,6 nuclear power and renewables, the EBRD region remains somewhat more reliant on “dirty” fossil fuels than the comparator countries (see Chart 4.3).

Fossil fuels (which include coal, oil and gas) remain the region’s primary energy source, being used to generate 81 per cent of its electricity in 2015 (compared with 74 per cent in comparator countries and 66 per cent in the rest of the world). The countries of the southern and eastern Mediterranean (SEMED) have the highest percentage (94 per cent on average – mostly on account of oil), followed by Russia, Turkey and Central Asia. In the SEMED region and Turkey, the use of fossil fuels increased between 1990 and 2015, primarily on account of a substantial rise in the use of natural gas. In central Europe and the Baltic states (CEB), by contrast, that share fell by almost 15 percentage points over the same period, primarily owing to a decline in the use of coal and peat.

Currently, renewable energy accounts for a small percentage of the total energy supply of the EBRD region, in part because of the weak institutional and regulatory framework for renewables. But Egypt, Mongolia, Turkey and a number of other countries in the region have significant potential to expand the use of wind power, while the SEMED region can tap its exceptional solar-energy resources.

Chart 4.2

Source: WDI and authors’ calculations.

Note: Data represent unweighted averages across countries. Comparator countries are emerging markets that are similar in terms of population size and income per capita (see Chapter 1 for details).

Chart 4.3

Source: IEA data from World Energy Balances.7

Note: Data represent unweighted averages across countries. Comparator countries are emerging markets that are similar in terms of population size and income per capita (see Chapter 1 for details).

Energy intensity of GDP

The energy intensity of GDP is determined largely by the sectoral structure of each economy and the amount of energy that is used to produce a unit of value added in each industry (which reflects the energy efficiency of the various industries), alongside other factors such as weather conditions and the standard of living.

Central planning led to both distortions in the sectoral structure of economies and intrinsic inefficiencies in the use of energy. Consequently, reductions in energy intensity can be traced back to structural changes (shifts towards less energy-intensive economic activities, such as services) and improvements in energy efficiency following the start of the transition process.

The average energy intensity of GDP in the EBRD region has more than halved since 1992. And yet, like carbon intensity, it remains above the level observed in comparator countries (see Chart 4.4). A more nuanced picture emerges when looking at energy intensity by country. Seven EBRD countries of operations were among the 20 most energy-intensive countries in the world in 2014: Turkmenistan, Ukraine, Uzbekistan, the Kyrgyz Republic, Kazakhstan, Russia and Moldova (in declining order of energy intensity). On the plus side, each of those countries had reduced its energy intensity relative to the early 1990s, primarily due to industry accounting for a smaller percentage of GDP. Similarly, services on average accounted for more than half of total value added in those countries in 2014, up from less than 35 per cent in 1990.

At the level of the EBRD region as a whole, the reduction in the energy intensity of GDP has been driven primarily by improvements in energy efficiency within individual sectors.8 In Turkey and the SEMED countries, energy intensity has exhibited only a slight downward trend, reflecting the fact that their energy intensity levels were already low at the start of the period when compared with post-communist economies. In that region, only Jordan saw its energy intensity fall by more than 25 per cent in the period 1992-2014, with that decline coming as a result of a shift towards non-electricity-intensive industries, as well as improvements in industries’ energy efficiency.9

The lower levels of energy intensity in SEMED countries do not necessarily reflect more labour intensive production processes. In fact, manufacturers in the SEMED region with at least five employees have lower labour intensity and higher capital intensity than manufacturers in other countries with similar levels of development.10 In the absence of investment in energy efficiency measures, this could lead to increases in energy usage and GHG emissions in the future.

Chart 4.4

Source: WDI and authors’ calculations.

Note: Data represent unweighted averages across countries. Comparator countries are emerging markets that are similar in terms of population size and income per capita (see Chapter 1 for details).

Management and energy intensity: the role of energy subsidies

When it comes to energy-efficient production structures, firms’ choices are influenced by their countries’ energy policies. Several countries in the EBRD region that are heavily reliant on fossil fuels for their energy supply subsidise fossil fuels and electricity generated from fossil fuels. With the exception of Cyprus, no countries in the region take account of costs associated with global warming, local externalities or forgone consumption tax revenues when setting energy prices (see Chart 4.5). This is a key policy distortion that makes fossil fuels (and electricity generated from them) cheaper for both households and firms, in turn affecting behaviour in terms of energy usage. According to the IMF, the EBRD region’s fossil fuel subsidies had a total value (excluding tax treatment) of US$ 112 billion in 2013 (equivalent to 1.7 per cent of the region’s GDP), while subsidies including tax treatment totalled US$ 699 billion (11.7 per cent of GDP).11

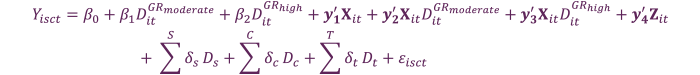

In order to investigate the relationship between energy subsidies and energy efficiency, the analysis in this chapter uses data on the energy costs and management practices of individual firms derived from the fifth round of the Business Environment and Enterprise Performance Survey conducted by the EBRD and the World Bank (BEEPS V) and the Middle East and North Africa Enterprise Survey conducted by the EBRD, the EIB and the World Bank (MENA ES), combined with other sources.12 Energy subsidies are calculated as the difference – referred to as the “price gap” – between the efficient energy price (which takes account of the direct and environmental costs of energy) and the actual price level for each country. In order to account for the fact that firms with high levels of energy intensity are more likely to benefit from subsidies, this analysis looks only at highly energy intensive sectors.

Overall, there is no statistically significant relationship between the quality of management practices and energy intensity, but the picture changes dramatically once the price gap is taken into account (see Box 4.2 for details). Improving the quality of management practices from the 25th to the 75th percentile of the distribution of management quality is associated with an increase of almost one-third in the energy intensity of production in countries with high energy subsidies – namely, those in the top 25 per cent of the relevant distribution (where the price gap averages US$ 17.7 per gigajoule of energy). In sharp contrast, the same improvement in management quality in countries where subsidies are negligible is associated with a reduction of more than 40 per cent in the energy intensity of production (see Chart 4.6).

These results indicate that although higher-quality management practices are associated with improvements in firms’ productivity, they may be linked to declines in environmental performance in the absence of incentives to economise on energy usage. Well-managed firms use energy inputs more efficiently, increasing productivity and reducing GHG emissions at the same time – but only when energy prices are not distorted by subsidies. Thus, governments that wish to reduce GHG emissions and their country’s carbon footprint should not only consider adopting climate change-related legislation, but also bear in mind the profound impact that energy prices can have on firms’ behaviour.

Chart 4.5

Source: IMF Energy Subsidies Template and authors’ calculations.

Note: These estimates relate to 2013 and include both consumption and production-related subsidies (inclusive of tax treatment). No data are available for Kosovo.

Chart 4.6

Source: IMF, BEEPS V, MENA ES and authors’ calculations.

Note: This chart reports the impact associated with improving the quality of management from the 25th to the 75th percentile of the distribution of management scores. Energy intensity is calculated as the energy cost per US dollar of sales, based on energy-intensive manufacturing industries only (see Box 4.2 for details). Solid bars denote estimates that are statistically significant at the 10 per cent level or higher.

The characteristics of green firms and their performance

Firms can reduce production-related emissions by manufacturing goods in a more environmentally friendly manner or by shifting production in favour of products and services that are better for the environment. For the economy to grow sustainably, resources need to be reallocated from less productive “dirty” firms to more productive green firms, as discussed in Chapter 2. While there are few studies looking at the impact that environmentally friendly goods have on firms’ performance levels, the impact of environmentally friendly production methods has been studied extensively.13 However, evidence for the EBRD region is scarce in both areas. This section aims to at least partially fill that gap.

Green production

This subsection investigates the link between environmentally friendly production methods and firms’ performance levels using data from the survey carried out by Anderson et al. (2011). That survey, which consisted of almost 800 telephone interviews with managers of manufacturing plants and addressed a variety of climate change-related topics, covered Hungary and Poland, as well as Belgium, France, Germany and the United Kingdom.

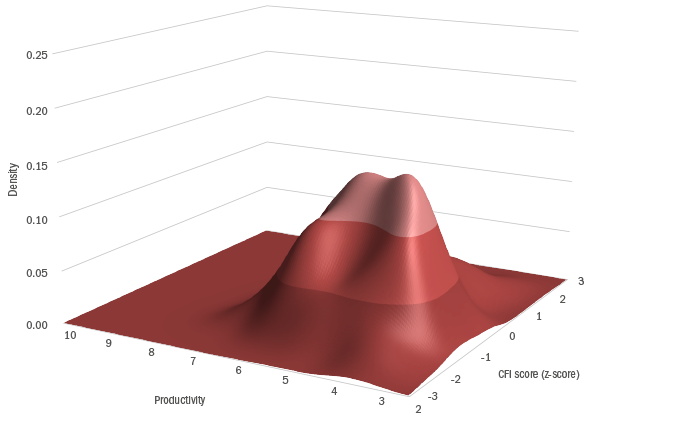

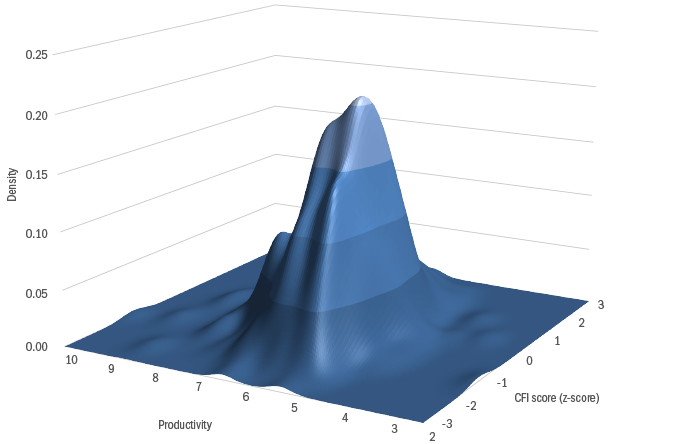

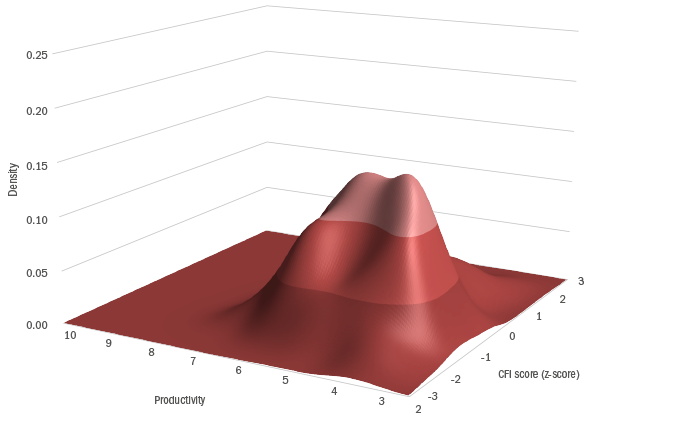

Firms’ green credentials are quantified using a Climate-Friendliness Index (CFI) – a summary measure combining a variety of different aspects, ranging from firm-level targets for GHG emissions and energy usage to climate-related product and process innovation (see Box 4.3 for details). On the basis of that measure, firms in Hungary and Poland are, on average, less environmentally friendly than their western European counterparts (see Chart 4.7).

Efforts to tackle climate change are sometimes regarded as coming at the expense of economic success, at least in the short run. However, several studies point to win-win opportunities when it comes to environmentally friendly behaviour and growth. The analysis in this chapter supports this view. The estimates in Table 4.1 suggest that improving the average firm’s green credentials by 1 standard deviation is associated with an 8.2 per cent increase in labour productivity, all else being equal. This effect is even larger in Hungary and Poland, where the relevant increase in labour productivity is close to 40 per cent.

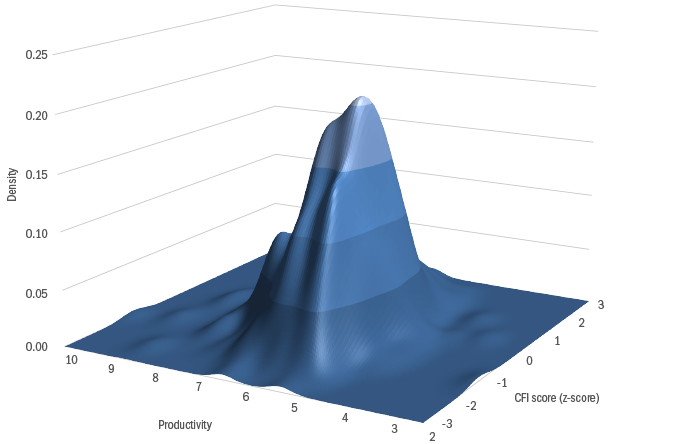

A closer look at the data suggests that the stronger relationship in central Europe might be due to a higher percentage of firms with low productivity,14 as less productive firms also tend to be less environmentally friendly. The density plot in Panel A of Chart 4.8 reveals a significant proportion of firms with low productivity and low CFI scores in central Europe, while no such bulge can be seen in the distribution for western Europe.

The stronger relationship between low productivity and low CFI scores in central Europe is largely driven by the measures subcomponent of the CFI. Indeed, firms in central Europe are significantly less likely to adopt energy-saving measures (beyond those relating to machinery) than their western European counterparts (see Chart 4.9).

It is also driven by the innovation and targets subcomponents. Having R&D facilities on site15 is positively and significantly correlated with productivity for central European firms, but not for their western European counterparts. While most western European firms in the sample do some form of R&D, many of the firms in central Europe that do no R&D are also underperforming.16 Analysis of the targets subcomponent suggests that low productivity firms in central Europe are not doing enough to measure their energy consumption properly.

Given the strong link between productivity and climate friendliness, it is interesting to see which factors contribute most to such scores. The most important determinant of the degree of climate friendliness is the size of the firm (see Chart 4.10), followed by the adoption of an environmental management system such as the ISO 14000 standards developed by the International Organization for Standardization (ISO), which provide a framework for firms looking to manage their environmental responsibilities. Indeed, firms that go through this voluntary certification process often do so in order to signal their commitment to protecting the environment.

Customer pressure also plays a role. If customers voice concerns about a firm’s emissions or request related data, that will encourage the firm to act in an environmentally friendly manner. At the other end of the scale, state-owned firms tend to be less environmentally friendly, perhaps because they enjoy greater monopoly power.17 For firms in central Europe, the single most important determinant of climate friendliness is the presence of R&D facilities on site.

Policy-makers can foster environmentally friendly behaviour by helping to create an environment in which successful SMEs can scale up production. As discussed in Chapter 2, SMEs in the EBRD region have fewer opportunities to grow. At the same time, larger firms are more likely to act in an environmentally friendly manner. Policy-makers can encourage firms to become more environmentally responsible by adopting stringent regulations on the measurement of energy usage or by making it easier for firms to access environmentally friendly technology. In addition, the power of customer pressure can be harnessed by requiring firms to publish a few key indicators of their impact on the environment. Some of these measures are likely to have a positive effect on environmental performance in return for a comparatively small outlay. In addition, governments can support green corporate R&D and strengthen links between industry and science in the area of green growth.

Chart 4.7

Source: Martin et al. (2017).

Note: Figures in parentheses denote the number of respondent firms per country. Average z-scores are obtained by regressing CFI scores on a set of country dummy variables, controlling for three-digit industry fixed effects, as well as various interview characteristics, and measuring the deviation of a country’s coefficient from the average across all country coefficients. The differences for France and Poland are statistically significant at the 1 per cent level.

Chart 4.8

Labour productivity and CFI scores: density plots

Panel A: Central Europe (Hungary and Poland)

Panel B: Western Europe (Belgium, France, Germany and the United Kingdom)

Source: Martin et al. (2017).

Note: Labour productivity is defined as the ratio of average turnover to average employment in the period 2006-10.

Chart 4.9

Source: Martin et al. (2017).

Note: See Box 4.3 for methodological details. All differences are statistically significant at the 10 per cent level or higher.

Chart 4.10

Source: Martin et al. (2017).

Note: Data represent standardised coefficients and are based on a regression estimated using ordinary least squares. All regressions include country and industry fixed effects (see Box 4.3 for details).

Table 4.1

Labour productivity and the CFI

|

(1) |

(2) |

| Dependent variable |

Labour productivity (log) |

| CFI |

0.079*** |

0.050* |

| (0.027) |

(0.028) |

| Poland/Hungary * CFI |

|

0.331** |

|

(0.160) |

| Observations |

715 |

715 |

| R2 |

0.6 |

0.61 |

Source: Martin et al. (2017).

Note: Estimated using ordinary least squares. Labour productivity is defined as the ratio of average turnover to average employment in the period 2006-10. All regressions include country and industry fixed effects (see Box 4.3 for details). Standard errors are shown in parentheses. *, ** and *** denote statistical significance at the 10, 5 and 1 per cent levels respectively.

Green revenue and trade

Having looked at how firms produce goods, this section now turns its attention to what they produce, looking specifically at products that help to mitigate, remediate or adapt to the negative consequences of climate change, resource depletion and environmental erosion. This subsection assesses the link between sales of green products and firms’ performance levels using FTSE Russell’s Low-Carbon Economy (LCE) database and Bureau van Dijk’s Orbis database. The LCE data define green products far more broadly than the title of that database might suggest (see Box 4.4 for details), with products ranging from flood barriers and electric cars to sustainably sourced crops.

On the basis of conservative estimates, less than 1 per cent of the revenue achieved by firms in the EBRD region in 2015 was generated in green sectors, compared with 4.2 per cent in comparator countries (albeit this needs to be interpreted with caution, as the sample for this calculation only includes 194 firms in seven EBRD countries).

While firms generate green revenue in a whole range of different industries, their activities tend to be concentrated in a small number of sectors (see Chart 4.11). While green revenue is highest (as a percentage of total revenue) in utility sectors such as water and waste collection, sewerage, and energy supply, sizeable amounts of green revenue are also generated in forestry and agriculture, engineering and some manufacturing sectors.

At the level of individual firms, companies with moderate amounts of green revenue (that is to say, green revenue is generated, but it accounts for less than half of total revenue) tend, on average, to be older and larger in terms of turnover and employment than firms with no green revenue at all. These companies may be diversifying their revenue sources as part of a long-term strategy or seeking to satisfy investors who are becoming more environmentally aware. In contrast, firms where green revenue accounts for more than 50 per cent of total revenue tend, on average, to be significantly smaller and younger than firms with no green revenue, pointing to the presence of large numbers of innovators.

Does it pay to produce green goods? Firms with green revenue tend, on average, to exhibit the same labour productivity as firms with no green revenue. Meanwhile, firms where green revenue accounts for more than 50 per cent of total revenue experience stronger sales growth (see Chart 4.12). However, those firms tend to be less profitable: the average return to equity for firms with large amounts of green revenue is just over one-third of that observed for firms with no green revenue. Similar patterns emerge once various firm-level characteristics and country, industry and year fixed effects are taken into account in regression analysis – although, with a few exceptions, differences in performance levels are not statistically significant (see Table 4.3).

On balance, producers of green products appear to be less profitable than other firms in the same sectors, perhaps partially on account of these firms being more recent entrants into the market. They tend to have higher valuations even if their current return on equity is lower than for their non-green peers. This suggests that investors expect higher future returns in this sector and put a premium on firms’ environmental performance. In 2017, for instance, Tesla (which makes electric cars) surpassed leading traditional car-makers such as Ford, General Motors and BMW in terms of market capitalisation – thanks to its growth potential, rather than its profitability.

There is also evidence that firms with green revenue are less leveraged than non-green firms. This suggests that green investments are seen as risky and may be shunned by traditional lenders. As a result, firms with green revenue need to rely more on equity as a source of financing (see also Box 4.5).

Chart 4.11

Source: FTSE Russell’s LCE database, Bureau van Dijk’s Orbis database and authors’ calculations.

Note: Figures in parentheses denote the number of firms per industry.

Chart 4.12

Source: FTSE Russell’s LCE database, Bureau van Dijk’s Orbis database and authors’ calculations.

Note: Data represent simple averages across firms.

Table 4.2

Average characteristics of firms by green revenue share in 2015

|

Green revenue |

|

None |

Up to 50% |

More than 50% |

| Turnover (€ million) |

3,414 |

5,611 |

1,764 |

| Number of employees |

13,016 |

17,930 |

6,963 |

| Age of firm (years) |

35.1 |

51 |

26.9 |

| Number of firms |

6,125 |

484 |

216 |

SOURCE: FTSE Russell’s LCE database, Bureau van Dijk’s Orbis database and authors’ calculations.

Note: Data represent simple averages across firms.

Table 4.3

Green revenue shares and firms’ performance

| Dependent variable |

(1)

Turnover per employee (US dollars; log) |

(2)

Return on equity (%) |

(3)

Return on assets (%) |

(4)

Turnover growth (%) |

| Firms with up to 50% green revenue |

-0.082 |

0.623 |

-0.492 |

-9.284*** |

| (0.157) |

(3.422) |

(1.548) |

(2.397) |

| Firms with more than 50% green revenue |

-0.367* |

-6.006 |

-3.667 |

9.387** |

| (0.219) |

(5.338) |

(2.404) |

(4.595) |

| Constant |

14.516*** |

-6.105 |

1.314 |

27.285*** |

| (0.180) |

(3.913) |

(2.045) |

(6.388) |

| R2 |

0.39 |

0.10 |

0.10 |

0.16 |

| No. of observations |

47,793 |

47,802 |

47,802 |

41,264 |

| No. of firms |

8,583 |

8,585 |

8,585 |

8,504 |

SOURCE: FTSE Russell’s LCE database, Bureau van Dijk’s Orbis database and authors’ calculations.

Note: Estimated using ordinary least squares. All regressions take account of country, year and industry fixed effects, as well as firm age, firm age squared, the log of the number of employees, indicators of state ownership, the number of companies in the group, the number of shareholders and whether the firm is listed or delisted (as opposed to unlisted), as well as interaction terms for selected variables and green revenue categories. Robust standard errors, clustered at firm level, are indicated in parentheses. *, ** and *** denote statistical significance at the 10, 5 and 1 per cent levels respectively.

Future prospects for the green economy

While green revenue currently accounts for only a small percentage of firms’ total revenue, the green economy has substantial growth potential. Global trade in low-carbon goods and services probably already exceeds US$ 1 trillion (see Box 4.6), and it can be expected to increase substantially over the next few decades18 if the global decarbonisation objectives agreed under the Paris Agreement are pursued.

This raises the question of how well prepared the EBRD region is for the advent of the low-carbon economy. In order to answer that question, this section looks at countries’ ability to convert existing production processes to low-carbon equivalents and develop the new goods and services that a low carbon economy will demand.

Progress in the area of low-carbon innovation

One useful indicator of the potential for a shift to a low-carbon economy is the degree of low-carbon innovation, which indicates the effort that is currently being put into developing clean products and processes for the future. Low-carbon innovation can be measured using the number of clean patents filed in a country. The European Patent Office (EPO) has a widely used classification system which identifies technological innovations that seek to mitigate climate change, distinguishing between clean patents relating to the energy sector, transport, buildings and carbon capture.19

Patents are not a perfect indicator of clean innovation, and clean innovation, in turn, is not a perfect indicator of countries’ ability to convert to low-carbon production. Innovations are not always patented, especially in the case of new processes. Moreover, many successful firms are early adopters of clean products, rather than their inventors, and many countries may lack the economies of scale and the skills base that are required to become leading product innovators.20 Indeed, the total number of patents filed in the EBRD region (both dirty and clean) remains relatively low.

Nevertheless, the link between green patenting and low-carbon innovation is strong, making this an informative – if imperfect – indicator of countries’ ability to convert to a low-carbon economy. Estonia and the Slovak Republic have the most clean patents in the EBRD region as a percentage of total patents (see Chart 4.13). Indeed, with low-carbon patents accounting for more than 10 per cent of all patents, these countries are – on this measure, at least – among the world’s cleanest innovators, on a par with countries such as France and Germany. In absolute terms, however, the number of green patents issued in these countries is small. Latvia, Romania, Lithuania and Hungary – and, to a lesser extent, Poland and Croatia – also perform relatively strongly, with clean patents accounting for more than 7 per cent of total patents. Turkey has the highest total number of patents, but less than 3 per cent of those are classified as clean.

Chart 4.13

Source: EPO and authors’ calculations

Note: Only countries with more than 100 patents over this period are included here. “Top innovators” denotes the 20 countries with the highest total numbers of patents worldwide. See Chapter 1 for a definition of comparator countries.

Chart 4.14

Source: UN Comtrade database, EPO, UNIDO INDSTAT4 2017 ISIC Rev. 3 and authors’ calculations.

Note: For both the Green Innovation Index and revealed comparative advantage, a score of more than 1 signifies performance above the global average (see Box 4.7 for details). The size of each dot is proportionate to the relevant sector’s contribution to national GDP. This chart covers the 12 largest manufacturing sectors in each country (on the basis of gross value added) which have filed at least 30 patents (11 sectors in the case of Hungary). See Annex 4.1 for a list of sector codes.

A SWOT analysis of low-carbon competitiveness

In order to obtain a more comprehensive picture of the economic opportunities and threats arising from a transition to a low-carbon economy, countries’ performance in the area of low-carbon innovation can be compared with their current areas of comparative advantage. The interplay between low-carbon innovation and current comparative advantages helps to identify potential strengths, weaknesses, opportunities and threats (SWOTs) in individual countries and specific manufacturing sectors with meaningful levels of overall patenting activity (see Box 4.7 for methodological details and Annex 4.1 for a list of industries). Chart 4.14 presents the results of this SWOT analysis for the six countries in the EBRD region with the highest overall numbers of patents.

This analysis suggests that Hungary, Poland and Slovenia are relatively well placed to embrace the low-carbon economy. Although Hungary’s main manufacturing sectors file relatively few patents, a reasonable percentage of these are clean, resulting in a range of low-carbon strengths (see top right quadrant) and opportunities (see top-left quadrant), including energy-efficient communication products (industry code 323). Poland and Slovenia both have good prospects in sectors such as chemicals (241-242) and plastics (252), and Poland is also well placed in terms of mineral products (269), while Slovenia is well positioned as regards accessories for motor vehicles (343). However, there are threats to Poland’s crucial meat and food processing industry (151) and Slovenia’s machinery sector (292).

For both Turkey and Ukraine, however, the low-carbon economy presents many more threats than opportunities. High-performing sectors include iron and steel (271) and textiles (172) in Turkey and plastics (252) and air/spacecraft (353) in Ukraine, but most other sectors are underperforming in the area of clean innovation. Ukraine’s crucial iron and steel sector has a low level of innovation overall – too low to be included in this analysis – with just one low-carbon patent being filed in the past 10 years.

Russia falls between these two groups of countries, faring far better than Turkey and Ukraine, but with fewer strengths and opportunities than the three EU countries. Metals (271-272) are an important area of strength, but the country’s crucial petroleum products sector (232) has an innovation score that is slightly below average, so it falls into the threats category.

These patterns are merely indications of potential trends. In many transition countries, the link between science and industry is weak and patents do not necessarily translate into new products. In Poland, for example, more than one-third of all patents issued in the period 2000-10 were held by universities or research institutes.21 On the other hand, some countries in the EBRD region may be well placed to benefit from low-carbon innovation in the future on account of existing production structures (see Box 4.8).

Conclusion

At the start of the transition process, the EBRD region was an outlier relative to comparator countries with similar levels of development, not only in terms of its industrial structure, but also in terms of the amount of GHG emissions that resulted from it. Encouragingly, aggregate GHG emissions have fallen since the 1990s, but they remain above the levels observed in equivalent comparator economies. Moreover, reductions in emissions have been driven primarily by increases in energy efficiency, rather than reductions in the carbon intensity of energy production. If the EBRD region is to unlock further reductions in emissions and meet its commitments under the Paris Agreement, its carbon intensity will need to fall considerably and its energy efficiency improvements will need to continue.

Putting economies on the path to green growth will require strong policies and strict implementation, starting with the elimination of energy subsidies and the introduction of reasonable carbon pricing. It will also require a strengthening of the institutional and regulatory frameworks for renewable energy. When electricity and fuel are subsidised, well-managed firms choose more energy intensive production structures, resulting in higher emissions. In contrast, when energy is appropriately priced, well-managed firms respond to price signals and reduce their emissions. Energy subsidies tend to be concentrated in countries that are heavily reliant on fossil fuels as a source of export revenue.

The transition to a green economy will be particularly challenging for the fossil fuel-rich countries where it may be necessary to adopt special policies in order to replace lost income (see Box 4.9). Meanwhile, other parts of the EBRD region are relatively well placed to achieve success in the low-carbon economy. There is evidence of green innovation in a number of areas, despite countries continuing to lag behind the technological frontier in terms of emissions, environmentally friendly production processes and the production of green goods.

While sales of green goods and services are still at a relatively low level, volumes are growing rapidly. Among publicly listed firms, green revenue is typically higher among smaller, younger firms. Firms with a large percentage of green revenue tend to be less profitable, partly because the business environment favours non-green products. The fact that such firms are in business is encouraging and suggests that investors expect higher future returns in this sector and put a premium on firms’ environmental performance.

Realising the region’s green growth potential will not be without challenges. It will require determined, far-sighted management and a willingness by the private sector to embrace the low-carbon economy. It will also require better policies on the part of governments. The private sector will look to governments to provide a business environment that is conducive to low-carbon investment. This should start with the removal of energy subsidies and the introduction of appropriate pricing of carbon emissions, but also include regulatory measures (such as efficiency standards) to encourage energy saving, policies to promote renewable energy, and the use of subsidies to promote low-carbon technology. In addition, more comprehensive social safety nets and retraining opportunities may be required in order to soften the structural impact of transition to a low-carbon economy. With the right policies in place, investment will start to flow to cleaner, more sustainable and more productive firms.

Box 4.1. Assessing “green transition”

The EBRD’s mandate is to foster sustainable market economies that are competitive, well governed, green, inclusive, resilient and integrated. With this in mind, a green index has been developed in order to quantify the performance of countries in the EBRD region in the area of “green transition”. In line with the EBRD’s operational strategy for green investment, this index comprises three equally weighted categories: mitigation of climate change, adaptation to climate change and other environmental areas.

The green index is based on a combination of physical and structural indicators, each normalised on a scale of 0 to 10, with 10 indicating the best performance. Physical indicators reflect environmental performance (for example, current and projected water stress), while structural indicators reflect regulatory or market responses to problems (such as water pricing). Physical indicators account for 35 per cent of the index, with structural indicators accounting for the remaining 65 per cent.

Each indicator is assessed relative to the performance of a “frontier country” (defined as the top performing OECD country in that area), with the various countries in the EBRD region being assessed in terms of their proximity to that frontier. Sweden, for example, is the frontier country for industrial emissions, with the Czech Republic, Germany and the United States of America acting as comparators for other indicators.

Results

The results of this analysis reveal that even the best-performing countries worldwide are some distance from the overall frontier when scores are averaged across all areas of the green economy (see Chart 4.1.1). Sweden tops the list, achieving a relatively modest score of 7.5 out of 10. Thus, all countries need to make more effort to tackle environmental concerns, notably the high level of CO2 emissions.

As regards the EBRD region, countries that are part of the EU perform best, with the CEB region leading the way. The Slovak Republic achieves the highest score (7.1), followed by Slovenia (6.7) and Poland (6.6). At the other end of the scale, the fossil fuel-rich countries of Central Asia record the lowest scores on account of poor regulatory/market responses to environmental concerns and very high CO2 emissions per unit of GDP.

This composite indicator has a number of limitations. First of all, given the time lags involved in the compilation of statistics, it may not capture the most recent developments in the area of green transition (such as the reduction seen in political support for renewables in Poland and various other EU countries). Second, the index focuses largely on commitments and objectives. Measuring the effectiveness of legislation is a more complex task. A final caveat concerns the limited number of indicators used to assess adaptation to climate change, as well as their simplistic and binary nature.

Chart 4.1.1

Source: World Bank, IEA (see footnote 7), EIA, World Health Organization, World Resources Institute, International Carbon Action Partnership, IMF, OECD, EBRD, ND-GAIN, CGIAR, Waste Atlas, IUCN Red List of Threatened Species, United Nations Environment Programme, United Nations Statistical Division, National Geographic and authors’ calculations.

Note: In the case of Kosovo, data are not available for all underlying indicators.

Box 4.2. Energy intensity, management practices and energy subsidies

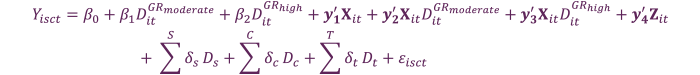

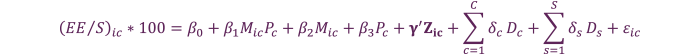

The relationship between energy intensity, the quality of management practices and the difference between the efficient energy price and its actual level can be estimated using ordinary least squares and survey-weighted observations on the basis of the following specification:22

where  and

and  denote energy expenditure and total sales respectively for firm

denote energy expenditure and total sales respectively for firm  in country

in country  . is measured as fuel expenditure, electricity expenditure or the total of the two.

. is measured as fuel expenditure, electricity expenditure or the total of the two.  is the difference between the efficient price of fuel, electricity or total energy and its actual level.

is the difference between the efficient price of fuel, electricity or total energy and its actual level.

Efficient energy prices take account of the cost of supplying energy, as well as the estimated costs of any externalities arising from energy usage (such as global warming, local air pollution, road congestion, car accidents and damage to roads).23 The actual price of fuel is the average of gasoline, diesel, kerosene, coal and natural gas prices and is calculated per gigajoule of energy. If the efficient price exceeds the actual price, the difference is attributed to energy subsidies.

The variable of interest is the management practices score  . Control variables include country (

. Control variables include country ( ) and sector (

) and sector ( ) fixed effects, firm-level characteristics (sales, capital, labour, age of firm, ownership structure, access to credit, whether the firm is a shareholding company with shares traded on the stock market, percentage of employees with a university degree, capacities utilised and self-generated electricity) and characteristics of the firm’s vicinity that could affect energy use (intensity of night lights and average January and July temperatures). The regression uses Taylor-linearised standard errors that account for survey stratification.

) fixed effects, firm-level characteristics (sales, capital, labour, age of firm, ownership structure, access to credit, whether the firm is a shareholding company with shares traded on the stock market, percentage of employees with a university degree, capacities utilised and self-generated electricity) and characteristics of the firm’s vicinity that could affect energy use (intensity of night lights and average January and July temperatures). The regression uses Taylor-linearised standard errors that account for survey stratification.

This analysis focuses on highly energy-intensive manufacturing industries (which are more likely to benefit from energy subsidies), looking at textiles, paper and paper products, coke and refined petroleum products, chemical products, non-metallic mineral products and basic metals.24

The focus is on coefficient  , which indicates the relationship between management practices and firms’ energy intensity with subsidies at different price-gap levels. Chart 4.6 indicates the economic impact of this coefficient for a hypothetical firm with energy intensity equal to the sample mean, reporting the estimated change in the firm’s energy intensity in the event of its management score improving from the 25th to the 75th percentile of the distribution of management quality.

, which indicates the relationship between management practices and firms’ energy intensity with subsidies at different price-gap levels. Chart 4.6 indicates the economic impact of this coefficient for a hypothetical firm with energy intensity equal to the sample mean, reporting the estimated change in the firm’s energy intensity in the event of its management score improving from the 25th to the 75th percentile of the distribution of management quality.

Box 4.3. Assessing firms’ green credentials

As part of the survey carried out by Anderson et al. (2011), almost 800 telephone interviews were conducted with managers of manufacturing plants in Belgium, France, Germany, Hungary, Poland and the United Kingdom between late August and early November 2009. That survey covered a variety of topics, including competition and other external drivers of climate change-related management practices, as well as specific measures adopted by firms in order to reduce energy consumption and GHG emissions. On the basis of the managers’ responses, a Climate-Friendliness Index (CFI) can be constructed in order to measure each firm’s green credentials.

Measuring firms’ green credentials

That CFI covers four areas: targets and monitoring, innovation, barriers to energy investment, and the adoption of energy-saving measures. The targets and monitoring questions focus on the scope and frequency of the firm’s monitoring of energy usage and GHG emissions, the types of energy and emissions targets that are in place at management level and the extent to which they are realistic, and the enforcement of those targets (including financial consequences in the event of their achievement or non-achievement).

The innovation questions ask whether firms commit staff time and financial resources (including for the purposes of R&D) in order to reduce GHG emissions and whether firms try to develop climate change-related products.

The question on barriers to energy investment asks whether the required payback time for energy-efficient investments is longer or shorter than that applied to non-energy-related cost-cutting measures.

Lastly, the last block of questions looks at the number of energy-saving measures adopted by the firm. These measures could be related to heating and cooling, energy generation, machinery, energy management, any other aspect of production, or non-production-related matters.

The scores for each aspect are converted into z-scores by normalising responses to each question to a mean of zero and a standard deviation of 1. First of all, four unweighted averages are calculated across the z-scores for each of the four areas. Those four averages are, in turn, converted into z-scores, averaged across the four areas and expressed as z-scores. This means that the average CFI score across all firms in all countries is equal to zero. Firms with a score in excess of zero are more environmentally friendly than the average firm.

Box 4.4. FTSE Russell’s LCE database: a description and analysis

Data

FTSE Russell’s LCE database consists of 11,789 publicly listed firms in 63 countries (including 213 publicly listed firms in seven EBRD countries)25 and covers the period from 2009 to 2015. For each firm, FTSE Russell provides information on the percentage of revenue that is “green”.

Revenue is deemed to be green where it is generated by goods or services that help to mitigate, remediate or adapt to the effects of climate change, resource depletion or environmental erosion. For example, flood barriers are a green product that helps to prevent flooding caused by increased rainfall. Such products are categorised on the basis of the LCE Industrial Classification System, which consists of eight LCE sectors (such as energy generation) and 60 subsectors (such as biofuels). For a number of firms (more than 15 per cent of all companies in the database), it is not possible to put a precise figure on the percentage of revenue that is deemed to be green. Instead, a range is indicated, with minimum and maximum values being provided. The analysis in this chapter employs a conservative approach and focuses on minimum green revenue shares.

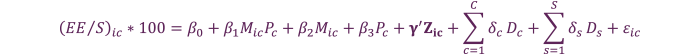

Analysis

For the purposes of the analysis in this chapter, the LCE database is combined with firm-level information from Bureau van Dijk’s Orbis database, whereby only observations including information on green revenue, turnover, numbers of employees, profit measures and industry classification are included. This results in a sample comprising 7,221 firms from 59 countries (including 100 firms in seven EBRD countries).

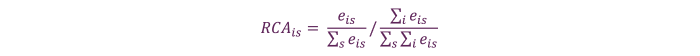

The relationship between firms’ performance levels and green revenue shares is estimated using ordinary least squares on the basis of the following main specification:

where  is the outcome variable of interest for firm

is the outcome variable of interest for firm  in sector

in sector  and country

and country  in year

in year  ,

,  denotes green revenue shares that are greater than zero and less than 50 per cent, and

denotes green revenue shares that are greater than zero and less than 50 per cent, and  denotes green revenue shares that are greater than 50 per cent. Firm-level control variables for age, age squared and the log of the number of employees and indicators of national, state or local government ownership (

denotes green revenue shares that are greater than 50 per cent. Firm-level control variables for age, age squared and the log of the number of employees and indicators of national, state or local government ownership ( ) are interacted with green revenue shares.

) are interacted with green revenue shares.  is a matrix of other control variables, including the number of companies in the group, the number of shareholders, and whether the firm is listed or delisted (as opposed to unlisted).

is a matrix of other control variables, including the number of companies in the group, the number of shareholders, and whether the firm is listed or delisted (as opposed to unlisted).  ,

,  and

and  are sector, country and year fixed effects, and

are sector, country and year fixed effects, and  is the error term. Standard errors are robust and clustered by firm.

is the error term. Standard errors are robust and clustered by firm.

There are a number of caveats that need to be borne in mind here. First of all, the sample is not nationally representative, as the FTSE Russell LCE database focuses on gathering information on the world’s largest firms in term of market capitalisation. Thus, only very large firms are included, and the majority of those firms are from China, Japan, the United Kingdom and the United States of America, which together account for more than 70 per cent of the sample. Second, the sample includes only 100 firms from the EBRD region, limiting the conclusions that can be drawn from this analysis. Lastly, because the analysis focuses on minimum green revenue shares, the results can be interpreted as lower-bound estimates. The results are qualitatively similar if mean or maximum green revenue shares are used instead.

Box 4.5. Financial development and industrial pollution

Growing financial systems tend to have a positive, causal impact on long-term economic growth26 and may, therefore, also influence pollution levels. As discussed in Chapter 1, pollution increases at early stages of development, but declines once a country reaches a certain income level.27 As countries get richer, voters may, for instance, start to demand stricter anti-pollution legislation. How do the growth and structure of the financial system shape this relationship between economic growth and carbon emissions?

Recent research based on data for 18 industries in 73 countries over a period of 39 years provides some initial insight into the way in which financial development and financial structures impact industrial pollution (as measured by the level of CO2 emissions).28 This analysis shows that higher levels of financial development are associated with higher levels of CO2 emissions. What is more, aggregate CO2 emissions per capita are strongly positively correlated with the development of credit markets, but strongly negatively correlated with the size of stock markets (see Chart 4.5.1). Results at industry level confirm these patterns. When the level of financial development is taken into account, a more equity-based financial system is associated with lower levels of CO2 emissions in industries that depend on external finance for technological reasons.

There are two channels through which credit translates into higher levels of industrial pollution and equity translates into lower levels. The first channel is intra-industry technological innovation, whereby industries adopt cleaner technology over time. As the financing of innovation often tends to involve equity rather than loans, access to equity markets facilitates the process of intra-industry technological innovation, while access to credit slows it down by facilitating the adoption of less innovative and less efficient dirty technology.

The second channel involves the reallocation of resources across industries, whereby – keeping the technology constant – stock markets reallocate investment to relatively clean sectors. Conversely, credit markets reallocate investment away from clean sectors.

It would seem from the data that the first channel is underpinning the negative relationship between stock market development and industrial pollution: stock markets appear to be well suited to facilitating the adoption of cleaner technology in polluting industries, whereas there is no evidence of credit markets playing such a role.

Chart 4.5.1

Source: De Haas and Popov (2017).

Note: Financial indicators are averaged over the period 1974-2013. “Bank credit” refers to credit to the private sector and excludes credit issued by central banks and cross-claims by one group of intermediaries against another.

Box 4.6. Trade in environmental goods

The diffusion of advanced and clean technology and services – also called “environmental goods and services” – will be key to achieving greener growth around the world. Trade barriers hinder access to such green goods and services and increase their cost for importing countries, thereby hampering the adoption of advanced green technology. Trade barriers can take many forms, including tariffs imposed on imports, as well as non-tariff barriers such as quotas, certification rules and local content requirements. While tariff barriers on many environmental products are moderate, non-tariff barriers are much higher.29 In some countries, total barriers are as high as 40 per cent (when expressed in tariff-equivalent units), thereby limiting opportunities for a structural shift towards greener growth.

The World Trade Organization (WTO) has been promoting free trade in environmental goods since the Doha Ministerial Declaration of 2001. However, although the EU and a number of other WTO members30 began negotiating an Environmental Goods Agreement (EGA) in 2014, progress has been slow. One of the major challenges in this regard is the definition of environmental goods. While some products (such as inputs for the generation of renewable energy or resource-saving equipment) undoubtedly have environmental benefits, such benefits are less obvious where goods have multiple uses spanning both conventional and green technology. With this in mind, the analysis in this box uses both a narrow definition of green goods and a broad one.

Global trade in environmental goods and services probably exceeds US$ 1 trillion, with markets and trade volumes growing rapidly. In the EBRD region, imports of environmental goods accounted, on average, for around 2 to 5 per cent of total imports in 2014, with such goods making up a particularly large percentage of imports in Central Asian economies. Export volumes are more limited, however. Even with a broader definition of green goods, there are only 10 countries in the EBRD region where environmental goods account for more than 4 per cent of total exports (see Chart 4.6.1).

The liberalisation of trade would make clean technology cheaper to import, thereby making the transition to a green economy more cost-effective. For the many transition countries that are already producing intermediate inputs and technology with environmental benefits, liberalised trade would also provide an opportunity to strengthen export competitiveness through spillovers of technology and knowledge.

Chart 4.6.1

Source: UN Comtrade and authors’ calculations.

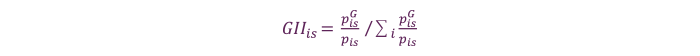

Box 4.7. Measuring drivers of the low-carbon economy

There are three leading indicators that may predict drivers of the low-carbon economy.31

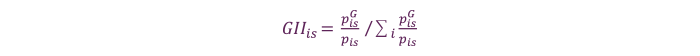

The first is the Green Innovation Index ( ), which is defined as green (clean) patents as a percentage of total patents in a given country and sector, relative to the percentage of green patents in that sector at global level. Formally, this is expressed as,

), which is defined as green (clean) patents as a percentage of total patents in a given country and sector, relative to the percentage of green patents in that sector at global level. Formally, this is expressed as,

where  is the number of clean patents and

is the number of clean patents and  is the total number of patents in sector and country (based on EPO data). Higher GII scores indicate a larger percentage of clean innovation in a given sector relative to other countries, and thus a more rapid conversion from conventional to clean production.

is the total number of patents in sector and country (based on EPO data). Higher GII scores indicate a larger percentage of clean innovation in a given sector relative to other countries, and thus a more rapid conversion from conventional to clean production.

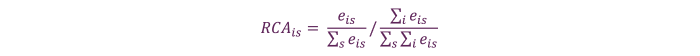

The second indicator is a sector’s revealed comparative advantage ( ), which is defined as that sector’s share in the total exports of the country, divided by that sector’s share in global exports. This is expressed as

), which is defined as that sector’s share in the total exports of the country, divided by that sector’s share in global exports. This is expressed as

where  is the volume of exports from sector

is the volume of exports from sector  in country

in country  (based on UN Comtrade data). A larger relative share in exports means that a sector has a greater RCA and is more competitive.

(based on UN Comtrade data). A larger relative share in exports means that a sector has a greater RCA and is more competitive.

The third and final indicator is green production at the outset, which is correlated with – and therefore measured using – total production in the relevant sector today, based on UNIDO data (INDSTAT4 2017, ISIC Rev. 3).

The analysis in this chapter covers industries at the three-digit level of disaggregation across 64 countries. In order to be included, a sector has to account for more than 1.5 per cent of national GDP and have filed more than 50 patents in total (both clean and dirty). This threshold is lowered to 30 patents if the sector is one of the three largest in the country or one of its top three patenting sectors.

These three indicators can be shown in a bubble chart, with the x-axis measuring RCA, the y-axis measuring GII scores and the size of the bubble indicating total production in the sector today (see Chart 4.14). Sectors in the top-right quadrant represent strengths – areas of comparative advantage (x-axis) with substantial green innovation (y-axis), which should ease the conversion to low-carbon products and processes. These sectors are well placed to remain areas of competitive strength in the low-carbon economy.

Sectors in the top-left quadrant represent opportunities. These are not currently areas of comparative advantage, but they are characterised by significant low-carbon innovation, which could facilitate the conversion to low-carbon products and processes. These sectors could therefore become areas of strength in the future, displacing less innovative incumbents.

Sectors in the bottom-right quadrant represent threats – areas where there is currently a comparative advantage, but insufficient low-carbon innovation. In these sectors, there is a risk that conversion to clean products and processes could stall and market share could be lost as the low-carbon economy grows.

Lastly, sectors in the bottom-left quadrant represent weaknesses. These are not currently areas of comparative advantage, and there is insufficient low-carbon innovation to establish a comparative advantage in the future.

Box 4.8. Green complexity and green competitiveness

Countries tend to develop new products and industries in areas where they already have a comparative advantage. In other words, future production capabilities are strongly dependent on existing industrial structures. The Economic Complexity Index (ECI)32 measures the diversity and complexity of economies’ productive capabilities on the basis of what countries export. In a similar vein, the Green Complexity Index (GCI)33 assesses the diversity and complexity of countries’ green exports, indicating the countries that are currently best placed to become leaders in the green economy.

Countries with high GCI scores tend to have high ECI scores, as many green products and technologies involve complex production knowledge. However, some countries demonstrate particular potential in the area of green products. Estonia, Hungary, Poland and Slovenia are the top-ranked countries in the EBRD region in terms of GCI scores. Estonia, for example, has significant potential linked to its existing capabilities in the area of complex measuring devices (such as spectrometers and optical instruments).

However, many countries will have to reorientate their existing industrial structures and cultivate new green industries in order to transition successfully to greener growth. This process will be easier for countries where existing capabilities are closer to the capabilities required to export new green products. This proximity is measured by the Green Complexity Potential (GCP) index.

A number of countries (including Egypt, Greece, Lithuania, Morocco, Poland and Turkey) have high GCP scores relative to their GCI scores (see Chart 4.8.1). These countries may be particularly well placed to develop future green capabilities, unleashing their potential in terms of income generation, employment growth, trade in green goods and the scaling-up of related services. Whether that ultimately happens will depend on whether or not they invest in the right skills and infrastructure. In many cases, new green technology requires specialist services facilitating its installation, operation and maintenance – services that are typically offered by local SMEs. If the benefits of green growth are to be maximised, there will also need to be international cooperation promoting trade in green goods with a view to benefiting all countries.

Chart 4.8.1

- Other

- EBRD region

- 45-degree line

Source: Mealy and Teytelboym (2017).

Box 4.9. Fiscal consequences of green transition for countries that export fossil fuels

The exact shape and pace of a country’s transition to a green economy is uncertain and will depend on the country’s development trajectory, the government’s policy responses and the availability of technology. (Services tend to be less energy-intensive than industry, for instance.) What is certain, however, is that transition to a green economy – combined with an increase in the use of renewable energy and higher levels of energy efficiency – will influence the price of fossil fuels and the value of related assets. If global prices cease to allow for the recovery of costs, many fossil fuel assets could become “stranded” – a situation that could lead to the unanticipated closure of production and the devaluation of assets, with assets potentially becoming net liabilities.34

As the owners of 70 per cent of all fossil fuel reserves and related assets worldwide, national governments have the potential to be heavily affected by this. Fossil fuels are often a major source of government revenue and an important area of expenditure.35 In the EBRD region, Azerbaijan, Egypt, Kazakhstan, Mongolia, Russia, Turkmenistan and Uzbekistan are particularly exposed. Kazakhstan’s recent experience offers a cautionary tale in this regard. Relatively high global oil prices between 2012 and 2014 allowed the Kazakh government to generate a regular budget surplus, as revenue from oil makes up around 50 per cent of total government revenue. However, falling fossil fuel prices in 2014 and 2015 resulted in a major shock to GDP and government revenue.

In order to make the best of the transition to a green economy, fossil fuel exporters will need to manage the risks resulting from green growth and exploit the opportunities. Fiscal policy and the management of public finances will be crucial when it comes to managing this process, with potential risks and opportunities arising on both the revenue and the expenditure side. If prices and production fall, governments will experience declines in fossil fuel revenue and a concomitant contraction in their fiscal base. This negative impact can be at least partially offset by the emergence of new sectors and revenue sources linked to the green economy, such as increases in the output of green firms or revenue from environmental taxes such as carbon pricing.36

In addition, falling asset values could lead to decommissioning costs, impairments and losses on asset sales. However, fossil fuel prices also affect the level of fossil fuel subsidies, which are prevalent across the EBRD region. For example, Turkmenistan’s fuel subsidies totalled around 16 per cent of GDP in 2014, according to IEA data. Lower fossil fuel prices mean a reduction in the need for subsidies, so reduced revenue from fossil fuels will be partially mitigated by falling subsidies.37

There are a number of policy responses available. First of all, general economic reforms can promote growth in other sectors. The nature of these reforms will necessarily be country-specific. In Kazakhstan, for example, improving the efficiency of state-owned enterprises while facilitating cross-border trade integration will foster growth in the non-extractives sector.38 Second, as long as fossil fuel extraction continues, governments should look to maximise revenues while also reducing risks to their balance sheets. This could, for example, involve improving the efficiency of production, fine-tuning tax policies and tailoring the country’s strategy for the extraction of fossil fuels to prevailing market conditions. And third, priorities on the fiscal policy side include the removal of fossil fuel subsidies encouraging consumption and production, the promotion of investment in the green economy and adherence to an effective budget process in order to manage fiscal risks.

Annex 4.1. ISIC Rev. 3 three-digit industry classification

Table A.4.1.1

Selected ISIC Rev. 3 three-digit industry codes

| Code |

Description |

Code |

Description |

| 151 |

Processing/preserving of meat, fish, fruit, vegetables, oils and fats |

292 |

Special-purpose machinery |

| 154 |

Other food products |

293 |

Domestic appliances |

| 171 |

Spinning, weaving and finishing of textiles |

311 |

Electric motors, generators and transformers |

| 172 |

Other textiles |

312 |

Electricity distribution and control apparatus |

| 181 |

Wearing apparel, except fur apparel |

319 |

Other electrical equipment |

| 232 |

Refined petroleum products |

321 |

Electronic valves and tubes and other electronic components |

| 241 |

Basic chemicals |

323 |

TV and radio receivers and associated goods |

| 242 |

Other chemical products |

331 |

Medical appliances/instruments, measuring/testing/navigating appliances |

| 252 |

Plastics products |

341 |

Motor vehicles |

| 269 |

Non-metallic mineral products |

343 |

Parts/accessories for automobiles |

| 271 |

Basic iron and steel |

351 |

Building and repairing of ships and boats |

| 272 |

Basic precious and non-ferrous metals |

352 |

Railway/tramway locomotives and rolling stock |

| 281 |

Structural metal products, tanks, reservoirs and steam generators |

353 |

Aircraft and spacecraft |

| 289 |

Other fabricated metal products; metalworking service activities |

361 |

Furniture |

| 291 |

General-purpose machinery |

369 |

Manufacturing |

SOURCE: UN Statistics Division (https://unstats.un.org/unsd/cr/registry/regcst.asp?Cl=2).

References

A. Al-Ghandoor (2012)

“Analysis of Jordan’s industrial energy intensity and potential mitigations of energy and GHGs emissions”, Renewable & Sustainable Energy Reviews, Vol. 16, pp. 4479-4490.

S. Ambec and P. Barla (2006)

“Can environmental regulations be good for business? An assessment of the Porter hypothesis”, Energy Studies Review, Vol. 14, pp. 42-62.

B. Anderson, J. Leib, R. Martin, M. McGuigan, M. Muûls, L. de Preux and U.J. Wagner (2011)

“Climate change policy and business in Europe: Evidence from interviewing managers”, Centre for Economic Performance Occasional Paper No. 27, March.

A. Ansar, B. Caldecott and J. Tilbury (2013)

“Stranded assets and the fossil fuel divestment campaign: what does divestment mean for the valuation of fossil fuel assets?”, Smith School of Enterprise and the Environment, University of Oxford.

N. Bloom, C. Genakos, R. Martin and R. Sadun (2010)

“Modern management: good for the environment or just hot air?”, Economic Journal, Vol. 120, pp. 551-572.

A. Bowen (2015)

“Carbon pricing: How best to use the revenue?”, Grantham Research Institute on Climate Change and the Environment and Global Green Growth Institute.

A. Bowen and S. Fankhauser (2011)

“The green growth narrative: Paradigm shift or just spin?”, Global Environmental Change, Vol. 21, pp. 1157-1159.

D. Coady, I. Parry, L. Sears and B. Shang (2017)

“How large are global fossil fuel subsidies?”, World Development, Vol. 91, pp. 11-27.

S. Dasgupta, B. Laplante, H. Wang and D. Wheeler (2002)

“Confronting the environmental Kuznets curve”, Journal of Economic Perspectives, Vol. 16, pp. 147 168.

R. De Haas and A. Popov (2017)

“Finance and pollution”, EBRD Working Paper, forthcoming.

EBRD (2011)

Special Report on Climate Change: The Low Carbon Transition, London.

EBRD (2014)

Transition Report 2014 – Innovation in Transition, London.

EBRD (2015)

Government assets: Risks and opportunities in a changing climate policy landscape. Methodology for calculating exposure under alternative policy scenarios, London.

EBRD (2017)

Kazakhstan diagnostic paper: Assessing progress and challenges in developing sustainable market economy, London.

EBRD, EIB and World Bank (2016)

What’s Holding Back the Private Sector in MENA? Lessons from the Enterprise Survey.

J. Endrikat, E. Guenther and H. Hoppe (2014)

“Making sense of conflicting empirical findings: A meta-analytic review of the relationship between corporate environmental and financial performance”, European Management Journal, Vol. 32, pp. 735-751.

S. Fankhauser, A. Bowen, R. Calel, A. Dechezleprêtre, D. Grover, J. Rydge and M. Sato (2013)

“Who will win the green race? In search of environmental competitiveness and innovation”, Global Environmental Change, Vol. 23, pp. 902-913.

G. Friede, T. Busch and A. Bassen (2015)

“ESG and financial performance: aggregated evidence from more than 2000 empirical studies”, Journal of Sustainable Finance & Investment, Vol. 5, pp. 210-233.

R. Hausmann, C.A. Hidalgo, S. Bustos, M. Coscia, S. Chung, J. Jimenez, A. Simoes and M.A. Yıldırım (2014)

The atlas of economic complexity: Mapping paths to prosperity, MIT Press, Cambridge, MA.

H. Haydock, A. McCullough, C. Nuttall, L. Evans, A.-L. Kaar, E. Bonifazi, R. Sibille, M. Houghton and S. Nair (2017)

UK business opportunities of moving to a low carbon economy, Ricardo Energy & Environment.

M. Kojima (2016)

“Fossil fuel subsidy and pricing policies: Recent developing country experience”, World Bank Policy Research Working Paper No. 7531.

R. Martin, M. Muûls, L. de Preux, H. Schweiger and U.J. Wagner (2017)

“Firms and the environment: Is there a difference between Eastern and Western Europe?”, mimeo.

P. Mealy and A. Teytelboym (2017)

“Economic complexity and the green economy”, mimeo, 4 September.

M. Nachmany, S. Fankhauser, J. Setzer and A. Averchenkova (2017)

Global trends in climate change legislation and litigation: 2017 update.

D. Nelson, M. Hervé-Mignucci, A. Goggins, S.J. Szambelan, T. Vladeck and J. Zuckerman (2014)

Moving to a low-carbon economy: The impact of policy pathways on fossil fuel asset values, Climate Policy Initiative Energy Transition Series.

OECD (2017)

Investing in Climate, Investing in Growth, Paris.

A. Popov (2017)